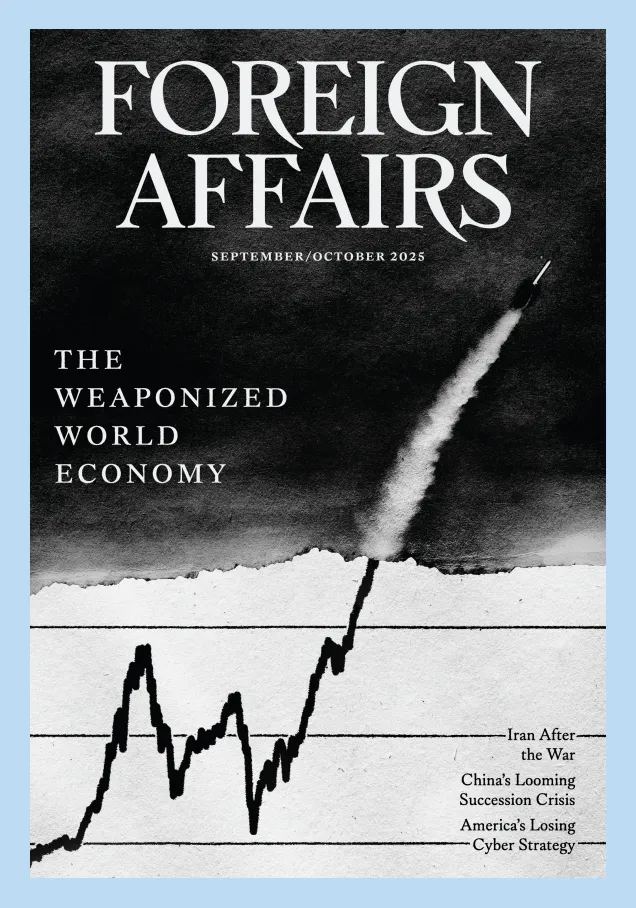

When Washington announced a “framework deal” with China in June, it marked a silent shifting of gears in the global political economy. This was not the beginning of U.S. President Donald Trump’s imagined epoch of “liberation” under unilateral American greatness or a return to the Biden administration’s dream of managed great-power rivalry. Instead, it was the true opening of the age of weaponized interdependence, in which the United States is discovering what it is like to have others do unto it as it has eagerly done unto others.

This new era will be shaped by weapons of economic and technological coercion—sanctions, supply chain attacks, and export measures—that repurpose the many points of control in the infrastructure that underpins the interdependent global economy. For over two decades, the United States has unilaterally weaponized these chokepoints in finance, information flows, and technology for strategic advantage. But market exchange has become hopelessly entangled with national security, and the United States must now defend its interests in a world in which other powers can leverage chokepoints of their own.

Read at Foreign Affairs.